D:

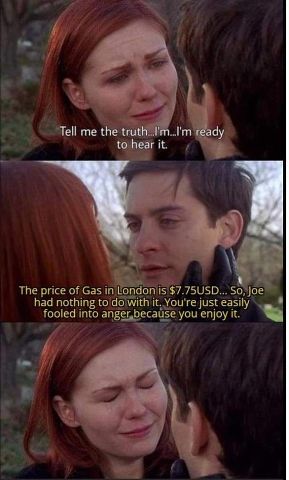

"Tell me the truth... I'm... I'm ready to hear it"

"The price of Gas in London is $7.75USD... So, Joe had nothing to do with it. You're just easily fooled into anger because you enjoy it.

*Cries*

Well, it's also because most of you consider high school to be higher learning.

A: Why do gas prices in England matter? They do not produce much of their own petroleum and every drop that comes into the country is highly taxed. They have no bearing on price or supply to the United States.

Me: QEII land accounts for 1.6% of the world's total oil consumption so absolutely there is some influence on global prices

A: At 1.6% of total consumption, there is very, very little influence, if any at all, on global pricing and supply.

Me: 1776 freedom land accounts for 20.3% of world oil consumption

So 1776 freedom land has 12 x (very very little influence, if any at all) on global pricing and supply

A: Since our beloved Sloppy Joe has killed our petroleum industry, our global influence on supply/demand and pricing has dwindled. However, if the USA stopped buying oil and gas tomorrow, there would be a large effect on gas prices globally. You should probably brush up on the principles Supply and Demand.

Me: The short run elasticity of oil prices to demand is estimated to be 0.25

Btw I have a degree in economics

A: from where, the Bernie Sanders School of Socialist Economics?

Me: I'm sure you are better at economics than economists working at the Federal Reserve who all have Ph.Ds in economics

"thirty studies estimate the short-run price elasticity of demand. Estimates of the demand elasticity range from −0.9 to −0.03, with the bulk of estimates between −0.3 and −0.1.

The “consensus” in the literature... is that... the demand elasticity is −0.13."

B: If we wanted the opinion of a Keynesian, we'd beat it out of you. Or turn on the propaganda machine on the wall.

A: and the consensus doesn't fit the studies because....what? Capitalism? Orange Man Bad? Google fucked up ? Or maybe you fat fingered the keys while yelling at squirrels?

B: Lemme lay something on you... Did you know the cost of living in Colombia is different than in the US? How about in China? Also different. I wonder, Mr. Economics Degree, why is that? I mean, they have stuff there, we have stuff here. So all the prices are really just the same, right?

Me: Guess you think that housing, like oil, is a tradable commodity

"The law of one price is an economic concept that states that the price of an identical asset or commodity will have the same price globally, regardless of location, when certain factors are considered."

B: Have you EVER read this concept before? This is in a frictionless market, lol. Do you think oil in the UK exists in a frictionless market? Or anything anywhere exists that way? It's in the absence of laws, currency rates, transaction costs, and EVERYTHING ELSE. Unbelievable. But that scans with your commie view of the world.

Me:

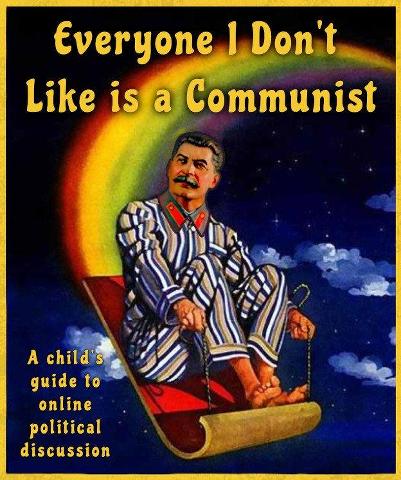

"Everyone I Don't Like is a Communist. A child's guide to online political discussion"

C: well that was a great way to sidestep the question

Me: I've spent enough time on the internet to recognise pointless arguments

I think these Americans hate Keynesians almost as much as they hate "commies"