"The math of immigration is never zero-sum, and the country’s resources are never finite. Over the long run, immigrant and refugee families do not just make the economy bigger, but also pay more in taxes than they take in benefits. They make the country stronger and richer, and its finances more sustainable."

I was curious about the details of this claim, so I looked at the link paper.

What I found was not quite what was advertised.

The abstract of the paper, New Findings on the Fiscal Impact of Immigration in the United States, concludes that:

"Highly-educated immigrants confer large positive fiscal impacts, contributing far more in taxes than they consume in public benefits. To the extent that immigrants impose net costs, these are concentrated at the state and local level and are largely due to the costs of public schooling."

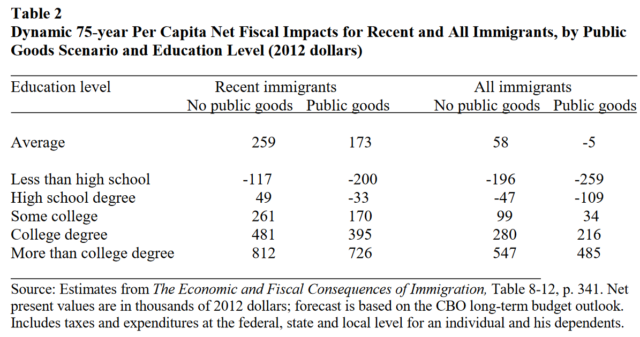

More specifically, Table 2: Dynamic 75-year Per Capita Net Fiscal Impacts for Recent and All Immigrants, by Public Goods Scenario and Education Level (2012 dollars), shows that even in the long run, even if you do not assign the costs of public goods ("the cost of national defense, interest on the national debt and foreign aid, among other shared expenses") to immigrants, those with a less than high school education are a net fiscal drag, and among all immigrants, those with only a high school degree are also a net fiscal drag.

Unfortunately, there is no breakdown of fiscal impact by both education and marginal cost of public goods, so we don't know if recent immigrants with a high school degree would have a net negative fiscal impact if the marginal cost of public goods were taken into account.

Some might say that the paper also points out that "the net fiscal cost of natives of similar education is far larger", but from a policy viewpoint a major objective of immigration policy presumably is to improve the fiscal situation - not make it even worse just because it's already bad (as the paper reminds us, we should use the marginal principle).

Similar research:

IZA World of Labor - Taxpayer effects of immigration

"The taxpayer effects of immigration need to consider the future paths of taxes and expenditures across generations. In the long term, the effects are positive in the US and in several European countries, and strongly positive for better-educated immigrants, but negative in other areas and for poorly educated and illegal immigrants and refugees