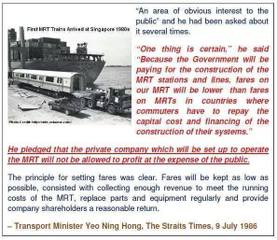

""An area of obvious interest to the public" and he had been asked about it several times.

"One thing is certain," he said. "Because the Government will be paying for the construction of the MRT stations and lines, fares on our MRT will be lower than fares on MRTs in countries where commuters have to repay the capital cost and financing of the construction of their systems."

He pledged that the private company which will be set up to operate the MRT will not be allowed to profit at the expense of the public.

The principle for setting fares was clear. Fares will be kept as low as possible, consisted with collecting enough revenue to meet the running costs of the MRT, replace parts and equipment regularly and provide company shareholders a reasonable return.

- Transport Minister Yeo Ning Hong, The Straits Times, 9 July 1986"

To take just one of many problematic aspects of this pledge 28 years later, let us consider the concept of a "reasonable return".

What is "a reasonable return"?

Let us take the example of OCBC, one of the STI companies.

OCBC's (a private BANK - which presumably is the most profit hungry industry) dividend from 2008 to 2012 ranged from 14-17 cents per share.

Adjusting for share price ($0.50 of dividend on a $1 stock is fantastic. On a $100 stock, not so), we get 1.7% to 2.1% dividend each year.

In the same period, SMRT's dividend per share ranged from 7.45 to 8.5 cents a share.

Adjusting for share prices (from the annual reports), we get 4.2% to 5.1% dividend each year.

Let's also look at Thai Beverage, a relative newcomer to the STI. From their 2012 annual report, their dividend per share in 2012 was 0.42 Baht per share. Using current exchange rates that's S$0.016 and they don't seem to have an average stock price per year. Taking the simple average of high and low stock prices, I get 0.05% dividend per $ of share price.

SMRT seems to be giving much better dividends than other companies. I think I should invest in it since other companies give "unreasonable" dividends.

| OCBC | |||||

| Year | 2008 | 2009 | 2010 | 2011 | 2012 |

| Dividend per Share |

$ 14.00 |

$ 14.00 |

$ 15.00 |

$ 15.00 |

$ 17.00 |

| Share Price |

$ 7.41 |

$ 6.78 |

$ 8.92 |

$ 9.02 |

$ 9.00 |

| Dividend per $ of Share Price |

1.9% | 2.1% | 1.7% | 1.7% | 1.9% |

| SMRT | |||||

| Year | 2009 | 2010 | 2011 | 2012 | |

| Dividend per Share |

$ 7.75 |

$ 8.50 |

$ 8.50 |

$ 7.45 |

|

| Share Price |

$ 1.53 |

$ 2.04 |

$ 1.89 |

$ 1.74 |

|

| Dividend per $ of Share Price |

5.1% | 4.2% | 4.5% | 4.3% | |

| Thai Beverage | |||||

| Year | 2012 | ||||

| Dividend per Share |

$ 0.016 |

||||

| Share Price |

$ 0.348 |

||||

| Dividend per $ of Share Price |

0.05% |